The Jetour T2: Redefining Adventure with Unmatched Capabilities

The Jetour T2 (marketed as the Jetour Traveler in China) represents a paradigm shift in the rugged SUV segment,

The global shift toward electric vehicles (EVs) is unmistakable, and China currently dominates this transformative landscape. With its unparalleled scale of production, cutting-edge technology, and government-backed innovation, China has emerged as the world’s largest EV market and manufacturing hub. As we approach 2025, the nation’s electric vehicle industry evolves rapidly, driven by advancements in battery technology, autonomous driving systems, and international expansion strategies. For B2B buyers and exporters seeking reliable partners in this fast-moving sector, understanding the top-tier Chinese EV manufacturers is critical.

This comprehensive guide highlights the top 10 high-quality electric auto manufacturers in China by 2025, analyzing their technological strengths, global supply chain roles, export capabilities, and strategic positioning. Whether you’re a electric vehicle suppliers exploring partnerships, a retailer seeking high-quality EVs, or an investor tracking market leaders, this in-depth analysis provides actionable insights to navigate China’s EV ecosystem successfully.

Overview:

BYD, one of China’s most iconic EV manufacturers, has surged to global prominence. As a vertically integrated company, BYD controls key components such as batteries, motors, and power electronics. In Q3 2023 alone, BYD sold over 2.89 million EVs globally, surpassing Tesla as the world’s top EV seller in 2023. The company’s 2025 goals include expanding its overseas footprint through partnerships in Europe, Southeast Asia, and Latin America.

Key Strengths:

Export Strategy:

BYD targets Europe aggressively, with models such as the Atto 3 now available in Germany, Norway, and the Netherlands. The company also supplies electric buses to over 60 countries, including the U.S. and the U.K.

2025 Prospects:

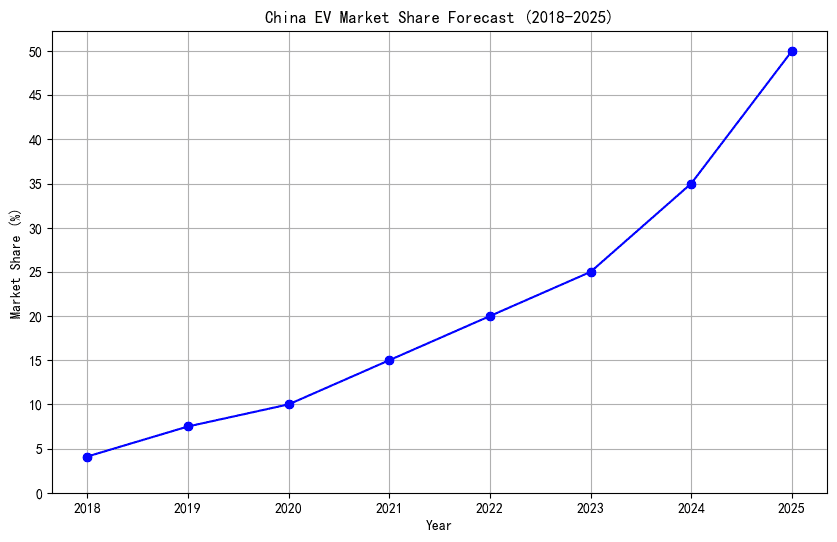

BYD aims to achieve 50% global market share in the EV segment by 2025 through expanded collaboration with global tech firms like Qualcomm and Precision Castparts. Its recent partnerships with automotive groups like Hyundai Mobis highlight its ambition to dominate both consumer and commercial vehicle sectors.

Overview:

NIO, a pioneer in China’s EV market, has carved a niche with its focus on premium electric vehicles and Battery as a Service (BaaS) model. Known for its design aesthetics and cutting-edge technology, NIO has established itself as a premium brand in markets like the U.S., Europe, and Asia.

Technical Edge:

Export Highlights:

NIO’s European network includes dealerships in Germany, Norway, Denmark, and the Netherlands. In 2025, it plans to launch solid-state batteries offering 1,000 km ranges, positioning it as a leader in next-gen energy storage.

2025 Strategy:

Expanding its international retail network to 10,000 dealers and enhancing its vertical integration with.By Tech (a subsidiary for chip design) to reduce reliance on foreign semiconductors.

Overview:

SAIC, a state-owned giant, leads China’s EV market through its flagship brand MG (Morris Garages) and its joint ventures with Germany’s Audi and Smart. SAIC’s 2025 strategic plan prioritizes domestic EV sales growth (target: 80% of domestic sales) and scaling exports to emerging markets.

Key Innovations:

Export Channels:

MG’s EV exports to the U.K., France, and Australia have tripled since 2020. The Cyberster electric roadster, previewed in 2023, is slated for global release in 2025.

2025 Roadmap:

Investing $5 billion in next-gen EV platforms and expanding battery swap stations in Europe to replicate NIO’s success in Asia.

Overview:

Chery, renowned for its cost-efficient exports to Africa, South America, and the Middle East, has expanded its EV line with the exE sub-brand. In 2022, Chery became China’s top EV exporter, shipping 880,000 units overseas.

Strategic Moves:

Export Strategy:

Focus on Southeast Asia (especially Thailand and Indonesia) and Eastern Europe. The oceanex SUV, co-developed with Italian design, will debut in Italy and Germany by 2025.

Overview:

Xpeng’s strength lies in its vertical integration in software, including in-house development of ADAS systems (XNGP), high-definition maps, and over-the-air updates.

Technical Breakthroughs:

Market Expansion:

Xpeng’s European launch in Germany, Netherlands, and Sweden has seen strong adoption for its G9 SUV. By 2025, it aims to capture 40% of China’s L3/L4 autonomous EV market and establish local R&D hubs in India and the European Union.

Overview:

Great Wall Motors (GWM) bets on multi-brand diversification to dominate mass-market EVs. Its brands—ORA (premium) , Wey (luxury) , and Tank (off-road) —cover segments from urban commuters to adventure-focused vehicles.

Innovation Highlights:

Global Ambitions:

Exports under ORA and WeY brands are expanding to South Africa and the Middle East. The SUV500 urban EV (0-60 mph in 4 seconds) targets U.S. buyers with an MSRP under $25,000 in 2025.

Overview:

Leapmotor distinguishes itself with L phase technology, a hybrid system combining EV batteries and gas generators for extended range. Its L9/L8 SUVs offer up to 1,800 km on a single fuel/battery fill-up.

Advantages:

Export Growth:

Leapmotor’s hybrid tech suits markets with limited charging infrastructure (e.g., Indonesia and Brazil). By 2025, it aims to secure 10% market share in the Indian EV market.

Overview:

Hozon, an NV (Newborn Vehicel) manufacturer, emphasizes robotic mobility and customizable AI cockpits.

Unique Offerings:

Overview:

This lesser-known firms focuses on electric commercial vehicles (delivery vans and minibuses). XPOLIC’s Starlink System optimizes route planning and driver analytics for logistics companies.

Key Markets:

Northern Africa and Southeast Asian countries with growing e-commerce sectors.

Overview:

Though once scandal-hit, Hanergy’s solar vehicle partnerships with tech firms like Apple (for iPhone/charging integration) position it for 2025 comeback.

Game-Changer:

BIPV (Building-Integrated Photovoltaics) Roofs on EVs recharge vehicles while parked in sunlight, boosting range by 20-30% annually.

When selecting a partner, consider:

China’s EV manufacturers are not merely catching up—they’re redefining global automotive norms. By prioritizing innovation and strategic partnerships, brands like BYD and NIO have outpaced legacy competitors. For B2B buyers, leveraging these partners means staying ahead of two key trends: the shift to sustainable transportation and the race for smart-mobility tech supremacy.

As markets evolve, prioritizing brands with vertically integrated supply chains (e.g., BYD, Great Wall) and strong overseas networks (Cherv) ensures long-term competitiveness.

Final Tip: Monitor geopolitical developments! China’s partnerships with ASEAN nations (expand.In 2025’s RCEP agreement) and Europe’s incoming ABV (Alternative Battery Vehicle) regulations will dictate compliance requirements and logistics costs—critical factors in your vendor selection.

By 2025, being an EV supplier/exporter in China means being a global innovator. These ten companies epitomize that vision—and offer unmatched opportunities for strategic alliances.

The Jetour T2 (marketed as the Jetour Traveler in China) represents a paradigm shift in the rugged SUV segment,

With over 110,000 pre-orders secured within a month of its March 2025 launch , the AITO

The Ideal L9, positioned as a flagship family SUV, redefines the standards of luxury, technology,